What is this

&it is an indicator that shows, in a simple and immediate way, the level of risk of the investment.

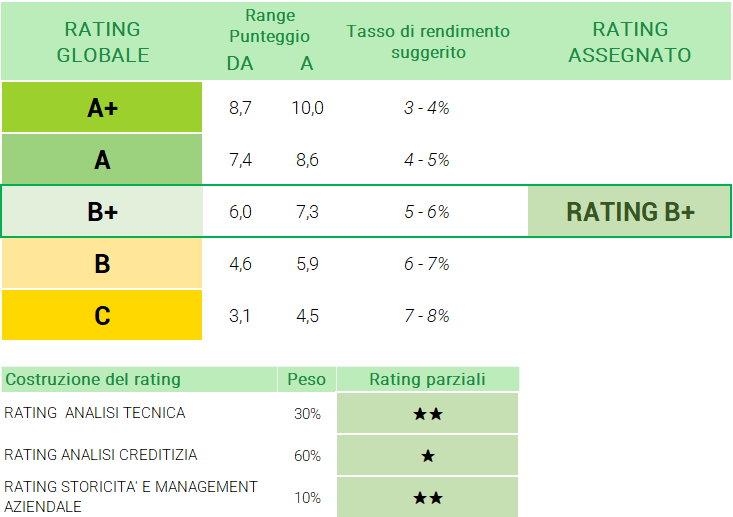

Each project is assigned a score (between 3 and 10) which corresponds to a rating: A +, A, B +, B, C.

What is it for?

Based on the calculation of this rating, the proposer offers a different rate of return: higher for riskier projects and lower for safer projects.

WARNING: This value represents an element of reflection that an investor must consider when deciding to participate in the loan. Investing always involves risk.